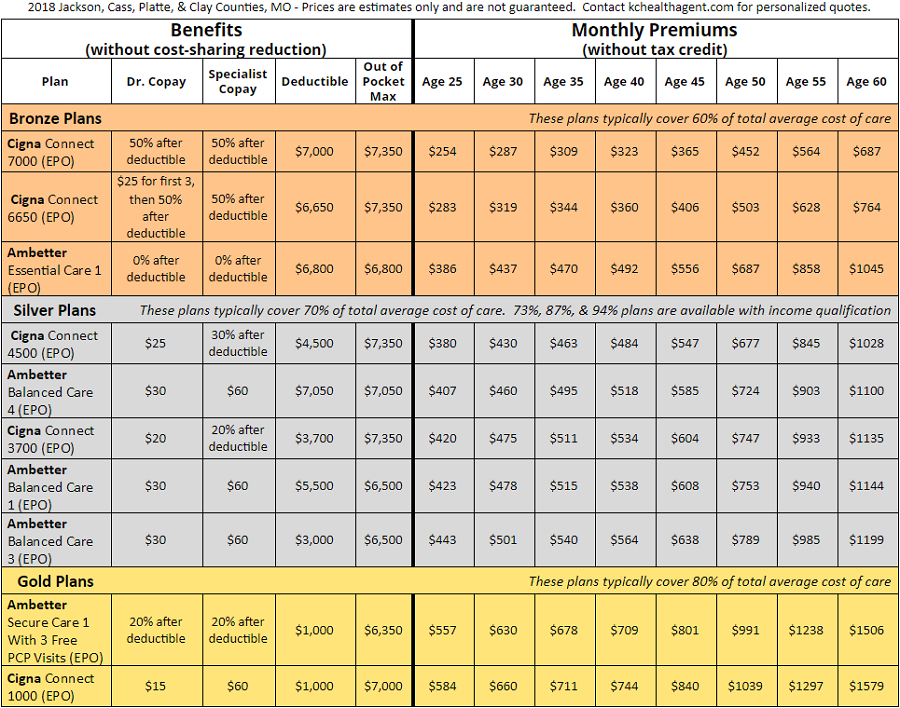

Health Insurance Quotes - Kanas City, MO (2018)

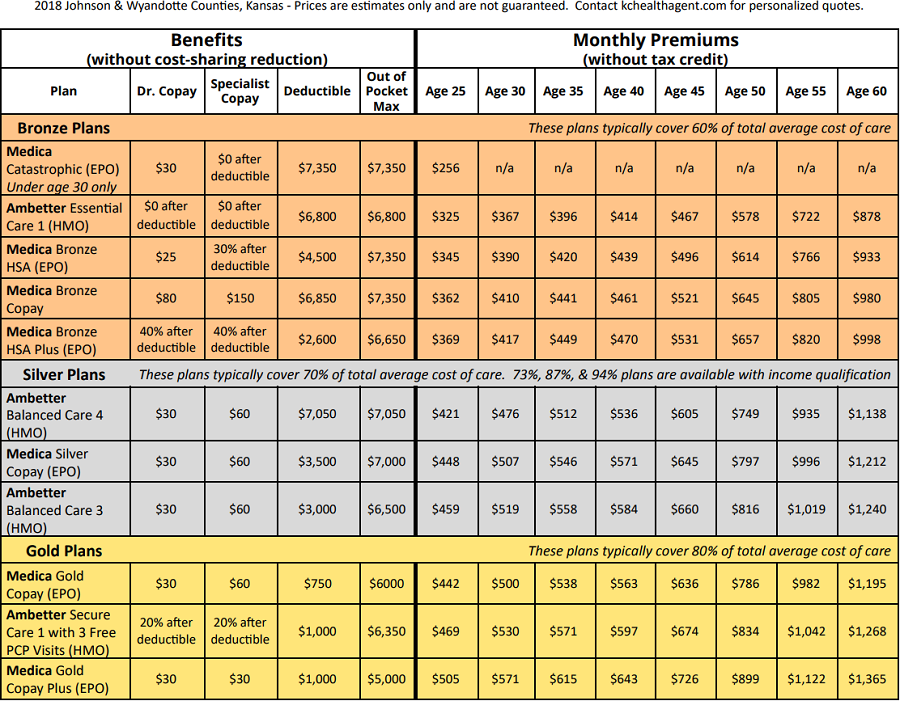

Health Insurance Quotes - Johnson & Wyandotte, KS (2018)

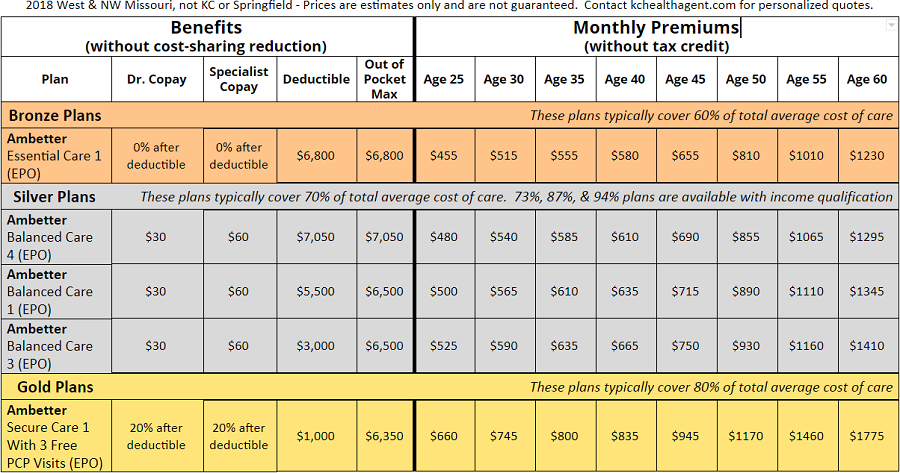

Health Insurance Quotes - West / NW MO (2018)

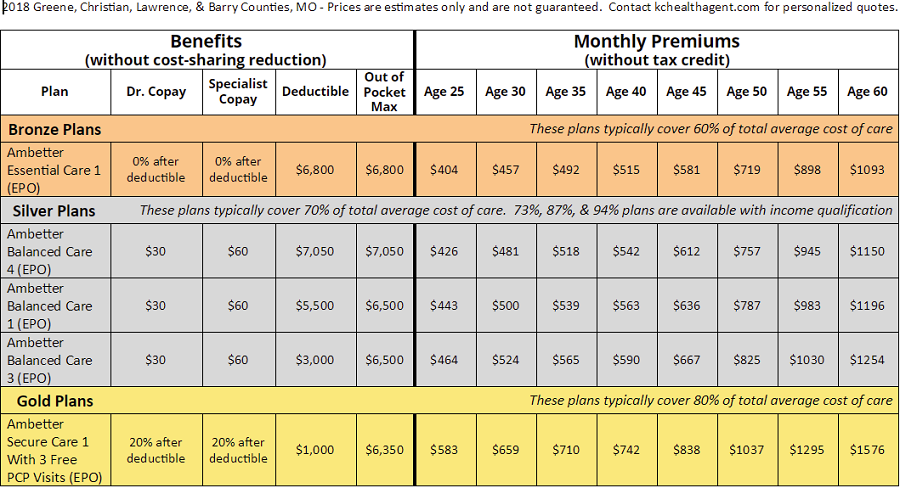

Health Insurance Quotes - Springfield MO (2018)

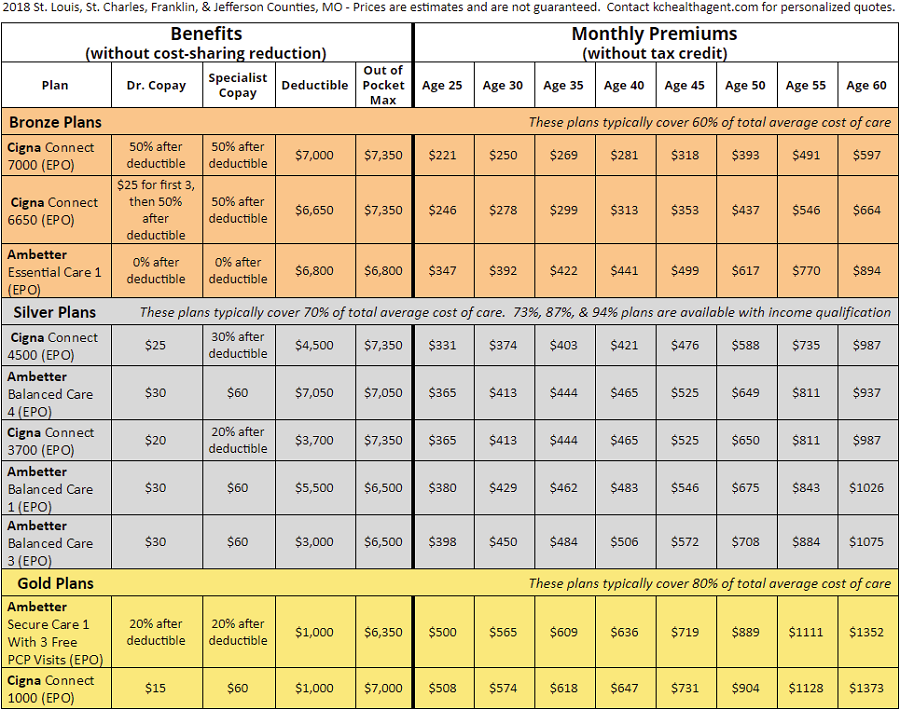

Health Insurance Quotes - Saint Louis MO (2018)

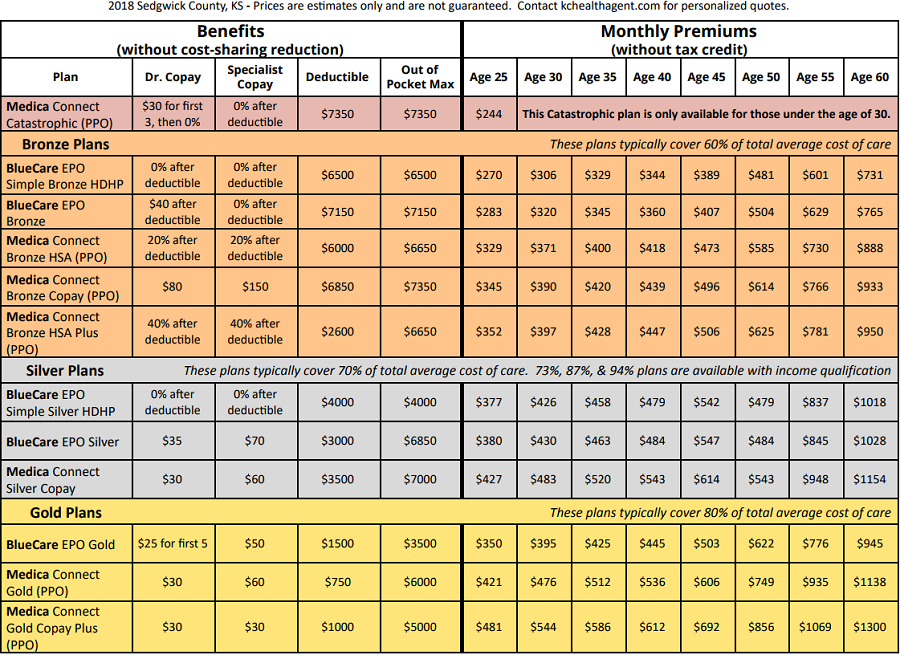

Health Insurance Quotes - Wichita KS (2018)